IS RESIDENTIAL LAND SUBJECT TO ANNUAL TAX & THE LATEST RESIDENTIAL LAND TAX CALCULATION 2023

Residential land is the common name of residential land (including rural and urban land) belonging to the group of non-agricultural land. According to Clause 1, Article 2 of the Law on Non-agricultural Land Use Tax, residential land in rural areas and residential land in urban areas must be taxable.

Accordingly, Clauses 1 and 2, Article 18 of Decree 126/2020/ND-CP stipulate the deadline for tax payment as follows:

The time limit for tax payment for the first time: 30 days from the date of issuance of the notice of tax payment.

From the second year onwards, taxpayers pay non-agricultural land use tax once a year by October 31 at the latest.

The deadline for paying the difference tax as determined by the taxpayer in the general declaration is March 31 of the calendar year following the tax year.

The time limit for tax payment for the adjusted declaration dossier is 30 days from the date of issuance of the notice.

Thus, residential land (rural land, urban land) is subject to annual land tax.

How to calculate residential land tax?

Under Articles 5, 6, and 7 of Circular 153/2011/TT-BTC, residential land use tax is determined as follows:

Amount of tax payable (VND) = Amount of tax incurred (VND) - Tax amount to be exempted or reduced (if any)

In there:

Amount of tax incurred = Taxable land area x Price of 1m2 of land (VND/m2) x Tax rate %

Thus, to calculate the amount of tax incurred, it is necessary to know: (1) the Taxable land area, (2) the Price of 1m2 of land, and (3) the Tax rate %

Specifically:

(1) Taxable land area

The taxpayer owns more than one parcel of land within a province: Taxable land area is the sum of the area of all taxable plots in that province.

The land plot has been issued with the Red Book: The taxable land area is specified in the red book. In case the residential land area recorded in the red book is smaller than in reality, the taxable land area is the actual land area when used.

Organizations, households, and individuals sharing the same land parcel that has not yet been granted a Red Book: the land area to be taxed is the actual land area used by the land user.

Organizations, individuals, and households using the same piece of land with a Red Book: The taxable area is the area recorded in the Red Book.

(2) Price of 1 m2 of taxable land

The price of 1m2 of taxable land is the land price according to the use purpose of the taxable land plot set by the provincial Peoples Committee (Land price list) and is stable over a 5-year cycle.

In case there is a change in taxpayers during the stabilization cycle or there are factors that change the price of 1m2 of taxable land, the price of 1m2 of land is not required to be re-determined for the remaining period of the cycle.

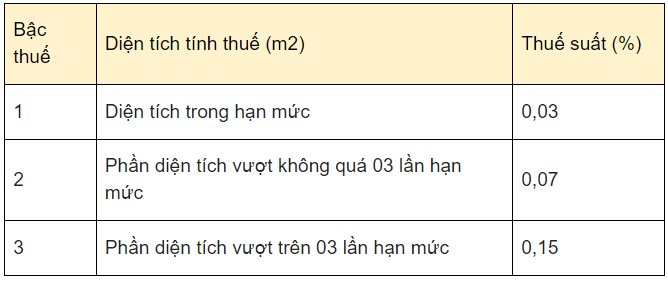

(3) Tax rate

The following partial progressive tax schedule applies:

Land for multi-story multi-family houses, apartment buildings, and underground constructions shall be subject to the tax rate of 0.03%.

Related article